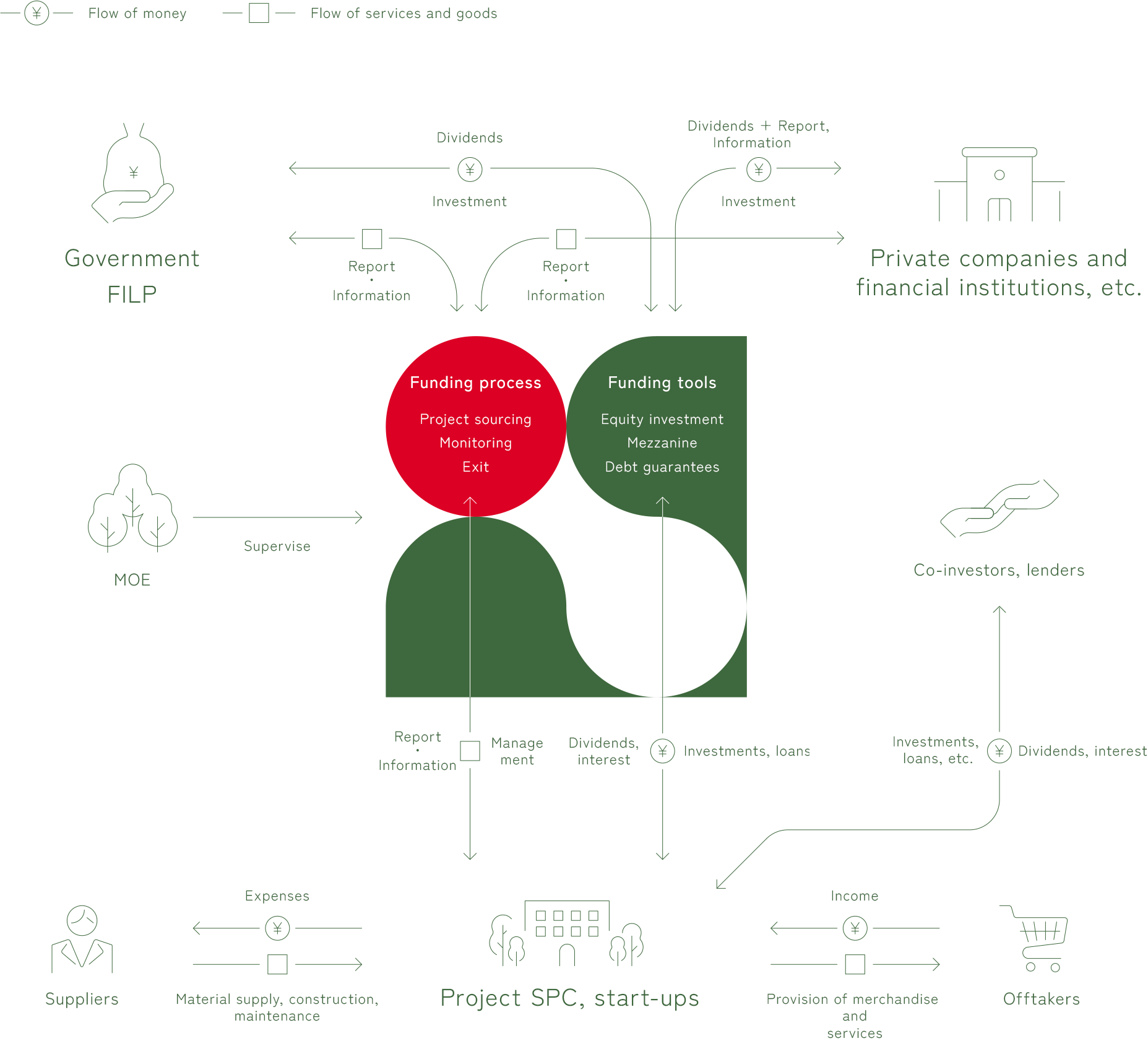

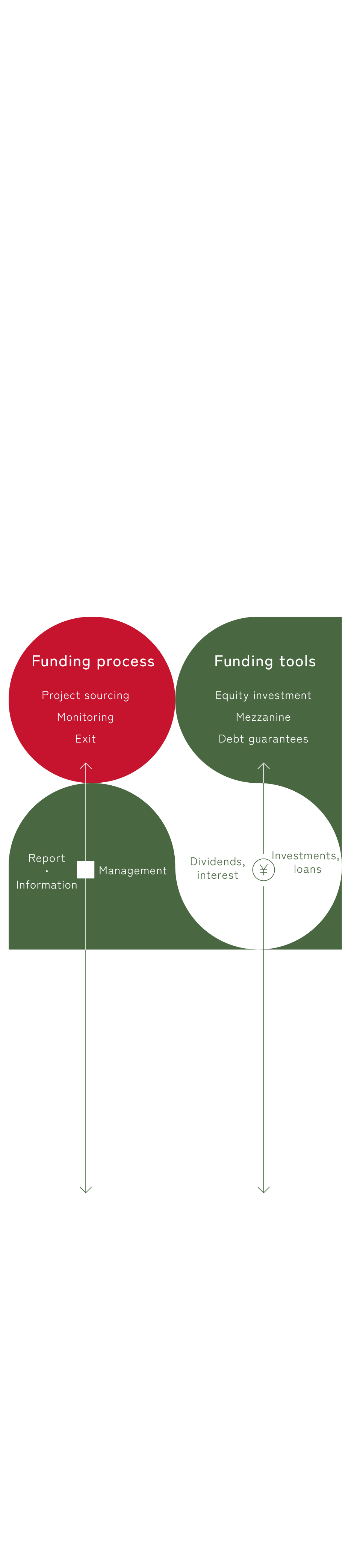

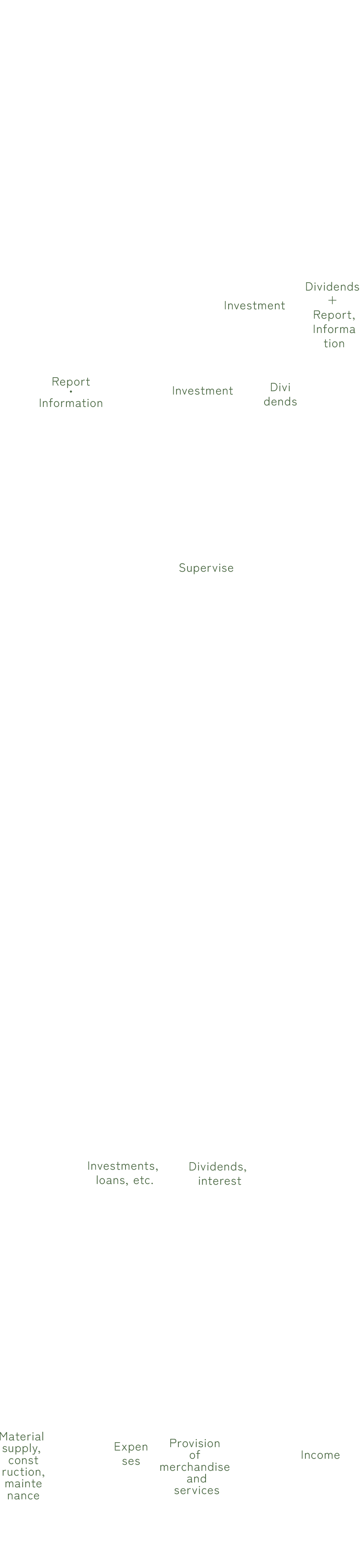

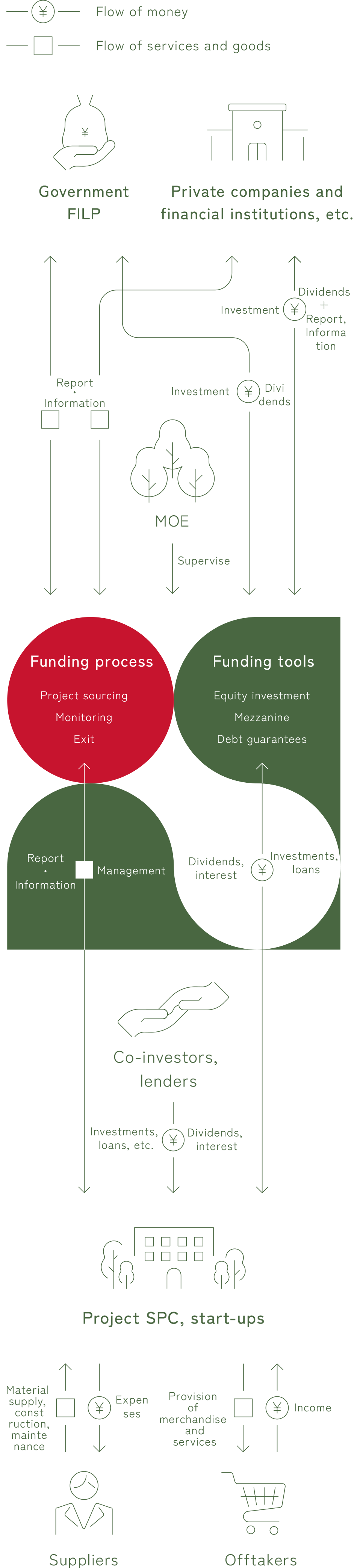

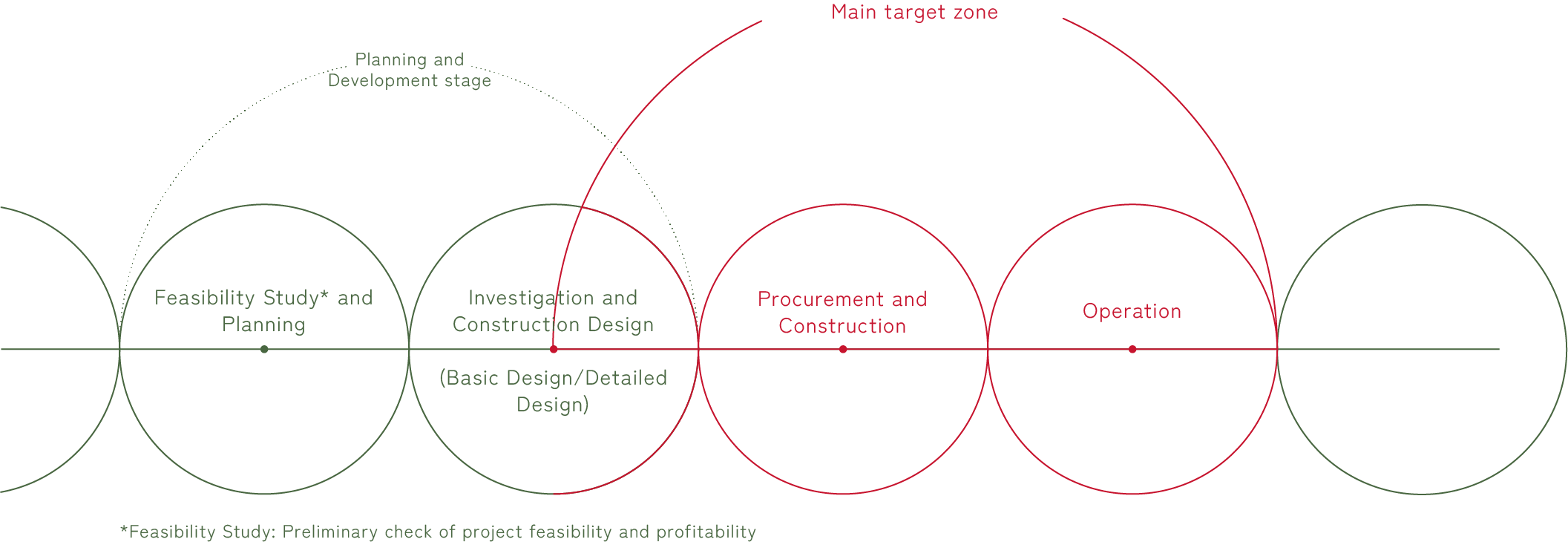

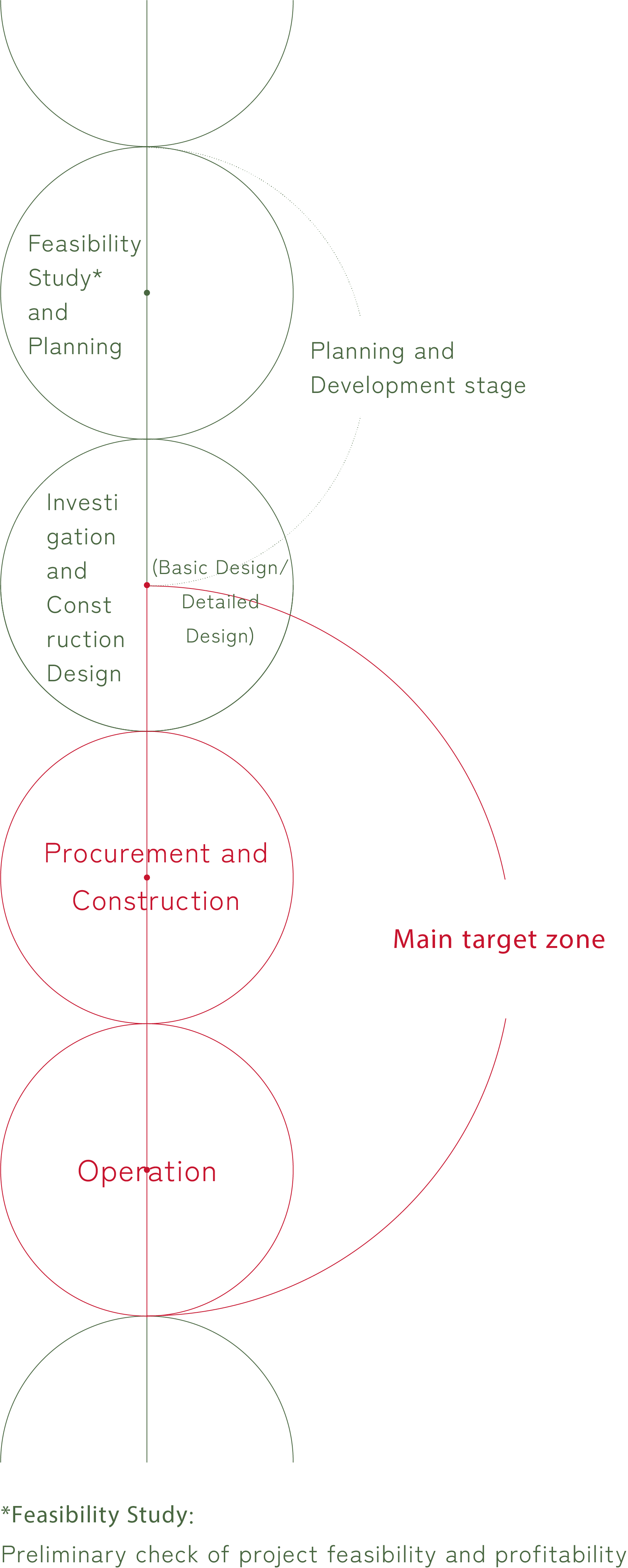

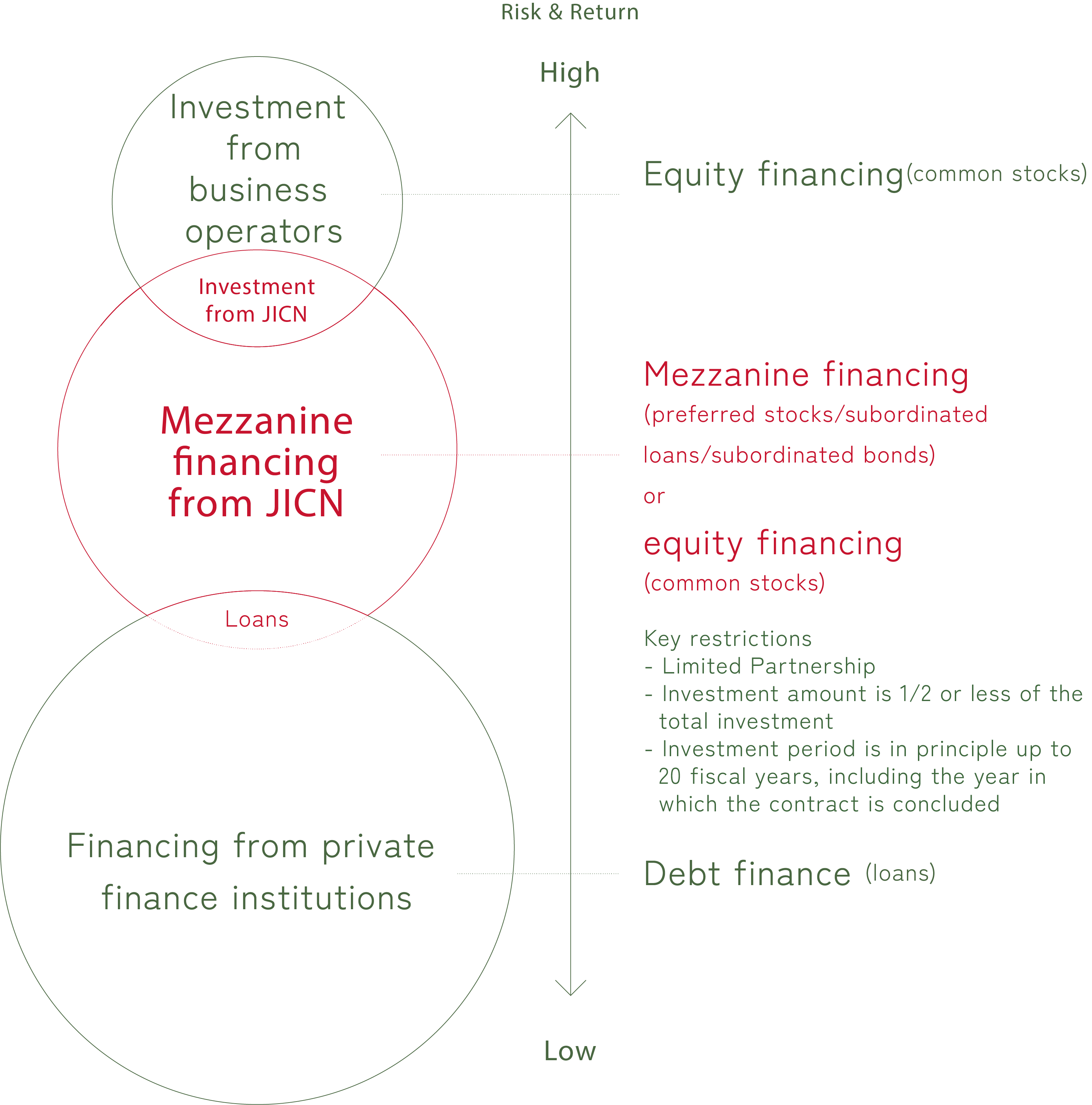

JICN implements investment and financing with capital from the Government’s Fiscal Investment and Loan Program(FILP) and private-sector investment to provide investment to various businesses involved in decarbonization. We bring out the strengths in capital, know-how, and human resources of various stakeholders to scale up efforts to achieve net zero by 2050, helping to ensure a better and sustainable future.